Other Ways to Give

- Make a gift in memory or to honor someone you care about

- Make a legacy gift in your will

- In-kind gifts

- Give a gift of stock or securities:

Make a bigger impact by donating securities and mutual funds!

A donation of securities or mutual fund shares is the most efficient way to give charitably. With a donation of securities or mutual funds, capital gains tax does not apply, allowing you to give more and avoid paying capital gains taxes. Learn more about charitable tax credits here.

It is easy to donate securities and mutual funds through Canada Helps. Learn how it works:

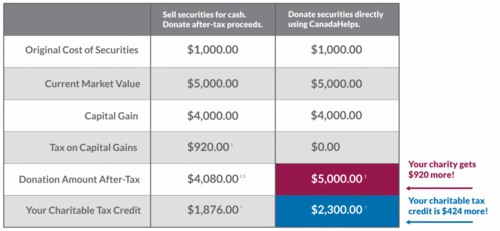

Let’s say you purchased common shares in ABC Company for a cost of $1,000 and a few years later they now have a current market value of $5,000. You would have a capital gain of $4,000.

The chart below illustrates what happens if you sell the shares and then donate the after-tax proceeds and what happens if you donate the shares directly using CanadaHelps.

By donating shares directly, you get a larger tax credit and give more to the charity you care about.*

Please note that while CanadaHelps accepts international donations, CanadaHelps is a Canadian charity and only issues Canadian tax receipts.**

US Donors who wish to receive receipts for US tax purposes should direct their donations through the Tides Foundation. Download and complete this form, completing highlighted sections and mail it with your cheque to the Tides Foundation in San Francisco, as indicated on the form. Tides Foundation will issue a receipt directly to you and will facilitate transfer to the Dalai Lama Center for Peace and Education, less a nominal administration fee. Charitable donation receipts are provided by the Tides Foundation within 4-6 weeks. Note: a minimum donation of $1,000 is required in this case.

Donors who wish to explore these options should contact President & CEO, Fiona Douglas-Crampton.

*1. This assumes a 46% marginal tax rate. For calculating capital gains tax, this rate is applied to 50% of the capital gain.

2. $4,080.00 represents the full value of $5,000.00 minus estimated tax of $920.00.

3. 3% fee applies to donations less than $10,000; 2.5% fee applies to donations between $10,000-$49,999; 2.25% fee applies to donations between $50,000-$99,999; 2% fee applies to donations $100,000+

These are general figures for the purpose of illustration. They do not constitute legal or financial advice. We strongly encourage you to seek professional legal and/or financial advice before deciding upon your donation to charity. Source: CanadaHelps.